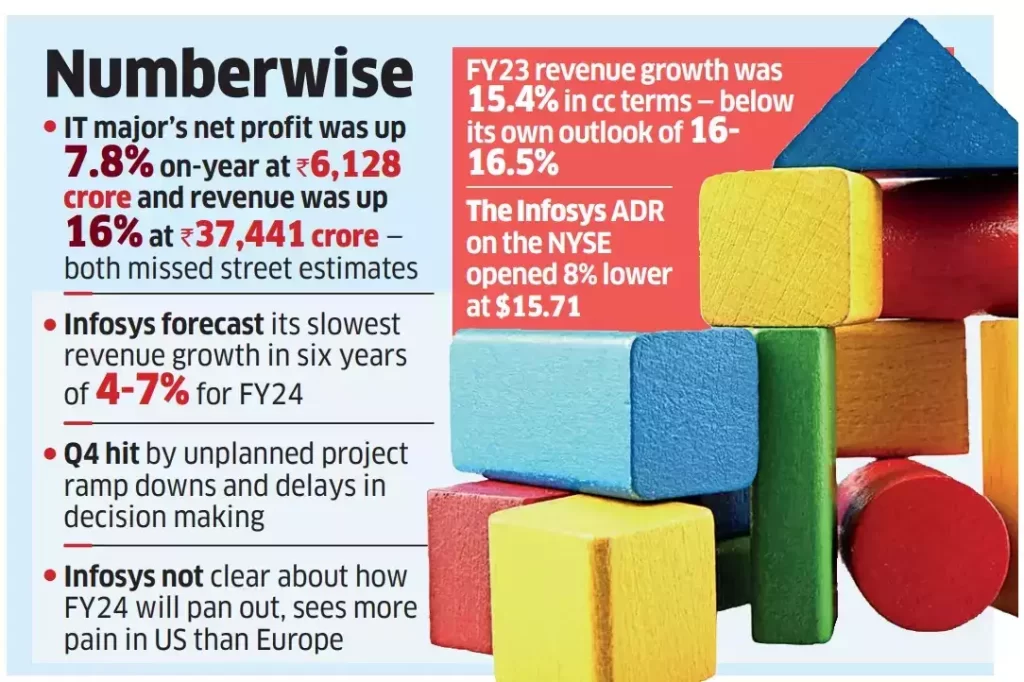

Indian software exporter Infosys has projected its slowest revenue growth in six years for fiscal year 2024, expecting a growth rate of 4-7%.

The company has attributed the “ramp downs” of client mandates to the uncertain macro environment in its major markets, namely the US and Europe. Infosys’ revenue increased by 15.4% in the fiscal year 2023, which was below its own guidance range.

Reasons for slow growth

Salil Parekh, the managing director of the company, has stated that the business environment is “uncertain” and the company does not have a clear view of FY24. He added that the third and fourth quarters of the fiscal year typically provide more clarity.

Parekh’s views are consistent with those of Infosys’ larger rival, Tata Consultancy Services (TCS), which reported weaker-than-expected results for the final quarter of fiscal 2023, flagging macroeconomic concerns, particularly in the banking and financial services segment.

For the March 2023 quarter, Infosys’ net profit was Rs 42,147 crore, up 10% year on year, while revenue rose 17.6% to Rs 2,25,458 crore. In the 2023 fiscal year, The company reported 9% year-on-year revenue growth at Rs 146,767 crore and 9% net profit growth at Rs 24,095 crore.

Infosys’ quarterly results

Infosys reported a net profit growth of 9% year on year at Rs 24,095 crore and a 20.7% growth in revenue to Rs 146,767 crore.

The company has attributed most of the revenue decline in the January-March quarter to a fall in deal volumes and “one-timers” like project cancellations and client-specific efficiencies and consolidation.

Infosys, a leading IT services company in India, reported its quarterly results on Thursday, which showed a 16% increase in revenue at Rs 37,441 crore. However, this figure fell short of the estimated Rs 38,796 crore from an ET poll of analysts. The revenue was down 2.3% sequentially.

See also: Google’s Bard Chatbot Updates Its New Page

The company also announced a final dividend of Rs 17.50 per equity share for the fiscal year ended March 31, 2023.

Infosys provided a revenue forecast for FY24, which is the lowest since FY18 when it saw growth of 5.8%. In fiscal 2023, the company’s revenue growth fell below its own outlook of 16-16.5% in constant currency.

CEO Salil Parekh cited challenges in the banking sector in both the US and Europe, which have hurt decision-making leading to a slowing cycle of deal closures. However, he noted that the company has an extremely large pipeline, with some mega deals with clients focused on efficiencies and consolidation.

Most of the revenue decline in the January-March quarter was due to a fall in deal volumes and “one-timers” like project cancellations and client-specific issues.

The sectors most affected include hi-tech, retail, financial services (mortgages, asset management, and investment banking), and telecom.

Revenue from financial services, which contributes the most among verticals, fell 1.3% on the quarter and 1.7% on the year.

Sanjeev Hota, head of research at Sharekhan by BNP Paribas, stated that the comments of Infosys management did not inspire confidence.

Infosys reported weaker-than-expected Q4 earnings, falling short of both the street and internal estimates. The company attributed the shortfall to the unplanned cancellation and ramp-down of projects across various sectors.

Hiring dips

In response to the weak outlook for its services, Infosys reduced its headcount by 3,611 employees on a net basis during the March quarter.

The company hired 29,219 professionals on a net basis, a 46% decline from the previous fiscal year’s 54,396 employees. The company finished the year with a total headcount of 343,234.

Infosys’ quarterly attrition rate for the quarter stood at 20.9%, a decline from the previous quarter’s 24.3% and the previous year’s 27.7%.

The company did not specify a target for this year’s campus hiring, but it did announce that it had hired 51,000 freshers for FY23. In comparison, TCS reported a target of hiring 40,000 freshers for FY24.

On Thursday, the Infosys stock closed 2.8% lower at Rs1,388.60 on the BSE, underperforming a flat Sensex. The results were announced after the market closed. Meanwhile, TCS shares closed 1.6% lower at Rs3,189.95.

See also: 12 Types of Propaganda Techniques Used in Advertising

Weak margin forecast

Indian software company Infosys has forecasted a weaker operating margin for FY24 at 20-21%, compared to 21-22% for FY23. The company’s operating margin for 4Q FY23 was at 21%, down 50 basis points from the previous quarter, which was attributed to higher employee and travel costs.

In contrast, Tata Consultancy Services (TCS) reported an operating margin of 24.5%. Infosys CFO Roy acknowledged that the company will face some margin headwinds in the current fiscal year due to compensation and travel costs, but they plan to increase margins through utilization and automation.

Analysts have expressed concern over Infosys’ weak total contract value (TCV) wins at $2.1 billion for the quarter, down 36% sequentially and 9% annually, and the sequential revenue decline in constant currency, which was worse than during the peak of Covid-19.

In the world of Indian IT, Infosys has reported large deal wins of $2.1 billion, a drop from $3.3 billion in the previous quarter and $2.3 billion a year ago. These “large deals” are defined as those worth at least $50 million in value. For the full fiscal year 2022, Infosys reported large deal orders of $9.6 billion compared to $9.8 billion in FY23.

Uncertain industry outlook

On the other hand, TCS has highlighted an “uncertain environment” and a slowdown in decision-making. It reported weaker-than-expected fiscal fourth-quarter results, with a 15% year-on-year rise in net profit to Rs 11,392 crore, on revenue of Rs 59,162 crore, up 16.9%.

Revenue growth at the Mumbai-based company was just 0.6% over the previous quarter on a constant currency basis.

For the full fiscal year ended March 2023, TCS clocked net profit at Rs 42,147 crore, up 10% year on year, while revenue rose 17.6% to Rs 2,25,458 crore.

Meanwhile, Infosys reported net profit growth of 9% year on year at Rs 24,095 crore and 20.7% growth in revenue to Rs 146,767 crore for the 2023 fiscal year.

See also: Boost Your Slack Productivity With ChatGPT App (ChatGPT App Integration For Slack)

In summary, Infosys’ slower revenue growth forecast for FY24 reflects the challenges faced by the Indian IT industry.

While the company has cited macroeconomic concerns and the cancellation of projects as the reason behind the slower growth, it has also noted that it has an extremely large pipeline with some mega deals with clients focused on efficiencies and consolidation.

The company’s focus on utilization and automation to increase margins is a positive development, but the weaker-than-expected TCV wins and revenue decline in constant currency are causes for concern.

Resource: At 4-7%, Infosys sees slowest sales rise in six years in FY24